All Categories

Featured

State Farm agents market whatever from home owners to automobile, life, and various other popular insurance coverage products. It's very easy for agents to pack solutions for price cuts and simple plan management. Lots of customers delight in having one relied on agent take care of all their insurance coverage needs. State Farm uses universal, survivorship, and joint universal life insurance coverage plans.

State Farm life insurance policy is generally traditional, using steady options for the average American household. Nonetheless, if you're looking for the wealth-building opportunities of universal life, State Ranch lacks competitive alternatives. Read our State Ranch Life insurance policy review. Nationwide Life Insurance Policy sells all sorts of universal life insurance policy: universal, variable global, indexed global, and universal survivorship policies.

Still, Nationwide life insurance strategies are highly obtainable to American family members. It aids interested parties obtain their foot in the door with a reputable life insurance coverage strategy without the much more complicated discussions concerning financial investments, economic indices, and so on.

Also if the worst happens and you can not obtain a bigger plan, having the defense of a Nationwide life insurance plan might transform a purchaser's end-of-life experience. Insurance business make use of medical tests to assess your risk class when applying for life insurance.

Customers have the choice to alter rates each month based on life circumstances. A MassMutual life insurance policy representative or financial advisor can aid buyers make plans with space for modifications to satisfy temporary and long-lasting financial objectives.

Best Variable Life Insurance

Some purchasers might be stunned that it provides its life insurance policies to the general public. Still, military members take pleasure in one-of-a-kind advantages. Your USAA policy comes with a Life Occasion Option cyclist.

VULs feature the highest risk and one of the most potential gains. If your plan doesn't have a no-lapse assurance, you might even lose coverage if your cash money value dips listed below a specific threshold. With so much riding on your financial investments, VULs require constant focus and maintenance. It might not be a terrific option for individuals who just want a death benefit.

There's a handful of metrics by which you can evaluate an insurer. The J.D. Power client contentment ranking is a good option if you want a concept of just how clients like their insurance coverage. AM Best's economic stamina score is one more vital metric to think about when selecting an universal life insurance company.

This is specifically vital, as your cash worth grows based upon the financial investment options that an insurance policy company offers. You ought to see what investment options your insurance coverage provider deals and contrast it versus the goals you have for your policy. The finest method to find life insurance coverage is to gather quotes from as lots of life insurance policy firms as you can to understand what you'll pay with each policy.

Latest Posts

Difference Between Universal And Whole Life

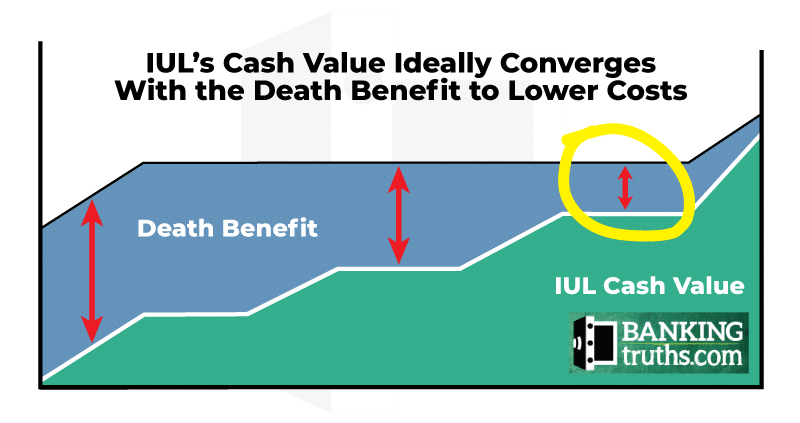

Equity Indexed Universal

Iul Explained